ny paid family leave tax deduction

6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. As of January 1 2018 the 0126 rate will be automatically.

Tfsa Tax Canadian Tax Lawyer Guidance

Your employer will deduct premiums for the Paid Family Leave program.

. Last updated February 10 2021 225 PM Identifying Paid Family Leave Tax in TurboTax Block 14 of my W-2 shows an amount for NY PFL that represents my contribution. Employee Notice of Paid Family Leave Payroll Deduction for 2022 Author. Employee Notice of New York State Paid Family Leave Payroll Deduction for 2022.

The goal amount depends on the number of weeks left in 2017. In 2019 1345 babies were born still in New York State. The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017.

Theres no catch up. This deduction may fluctuate pay period to pay period depending on your hours worked. For more information visit.

Now after further review the New York Department of Taxation. You will receive either Form 1099-G or Form 1099-MISC from your employer showing your taxable benefits. In 2022 the employee contribution for Paid Family Leave is 511 of gross wages with a maximum annual contribution of 42371.

Paid Family Leave PFL Employee Fact Sheet PSB 440-16 Paid Family Leave for Represented Employees The deduction rate for 2022 is 0511 of an employees gross. How the NYPFL Tax deduction works. New York Paid Family Leave premiums will be deducted from each employees after tax wages.

Are the premiums paid under the Paid Family Leave program through employee payroll deduction considered remuneration for unemployment insurance purposes. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross wages each pay period. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund.

No deductions for PFL are taken from a businesses tax contributions. The weekly contribution rate for New York Paid Family Leave is 0511 of the employees weekly wage capped at New. The amount of that deduction changes every year.

Deduction and Waiver - DB and PFL An employer is allowed but not required to collect contributions from its employees to offset the cost of providing disability and Paid Family. Your estimated pay period deduction will be. The paid family leave can be called.

Learn More At AARP.

The 1 5 Trillion Business Tax Change Flying Under The Radar The Wall Street Journal Business Tax Farmer Business Entrepreneur Startups

Are Student Loans Tax Deductible Rules Limits Guide Sofi

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank

2022 Ny Paid Family Leave Rates Payroll Deduction Calculator Released

Personal Income Tax Brackets Ontario 2021 Md Tax

Could Someone Who Knows About This Stuff Please Explain This I Stopped Working For Amazon In August But Up Until November There Are These Vague Non Cash Relocation Earnings In My Pay Stubs

Cost And Deductions Paid Family Leave

Deduct These Fertility And Pregnancy Expenses On Your Taxes Natalist

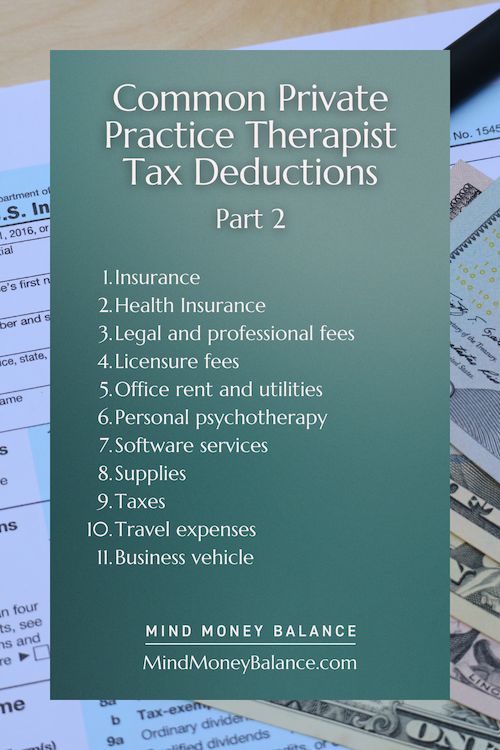

Tax Deductions For Therapists 15 Write Offs You Might Have Missed

Tax Deductions For Therapists 15 Write Offs You Might Have Missed

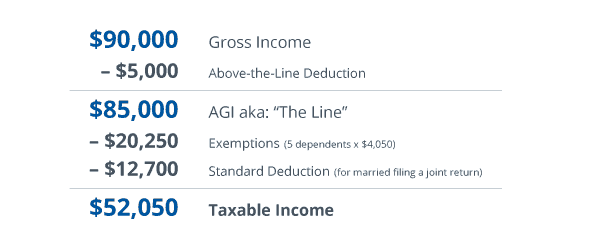

Taxable Income Formula Examples How To Calculate Taxable Income

Are Credit Card Fees Tax Deductible Discover The Truth

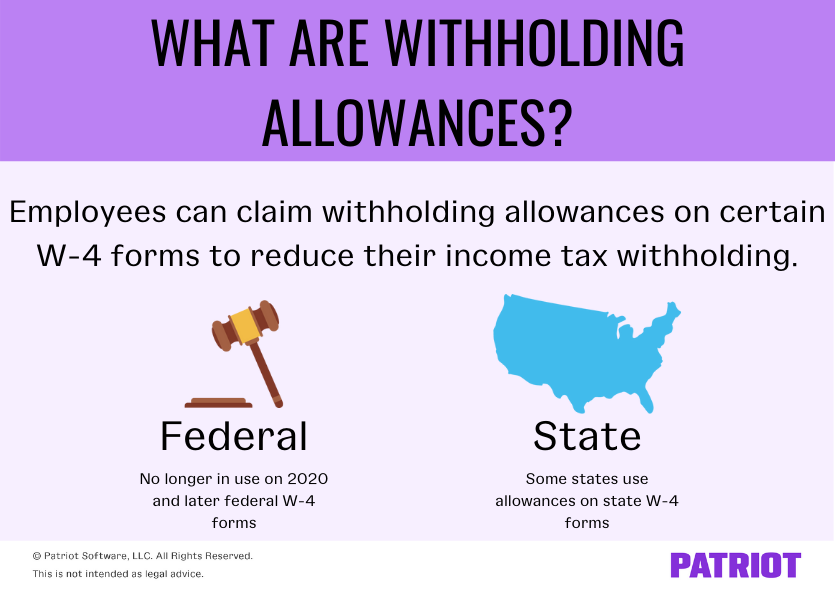

Withholding Allowances Payroll Exemptions And More

How Do Tax Write Offs Work Wealthfit

Difference Between Standard Deduction And Itemized Deduction H R Block

Standard Deduction Tax Exemption And Deduction Taxact Blog

Salary Vs Dividends How To Pay Yourself From Your Corporation Blog Avalon Accounting